- Mortgage calculator extra payment 2 weeks later how to#

- Mortgage calculator extra payment 2 weeks later full#

Lower Monthly Payments: Reduce the loan amount and monthly costs.However, a larger down payment offers several advantages: Typical Amounts: Down payments commonly range from 3.5% to 20%. The down payment is your initial contribution to the purchase of a home, typically represented as a percentage of the property's value.

I = Monthly interest rate (your annual interest rate divided by 12) n = Number of payments (loan term in years multiplied by 12 months) P = Principal loan amount (negative number representing the amount borrowed) You can use the PMT formula in Excel or Google Sheets to get a P&I payment: M = Monthly mortgage payment P = Principal loan amount (the amount you borrowed) i= Monthly interest rate (your annual interest rate divided by 12) n = Number of months required to repay the loan (loan term in years multiplied by 12) The formula to calculate the monthly mortgage payment by hand is:

Mortgage calculator extra payment 2 weeks later how to#

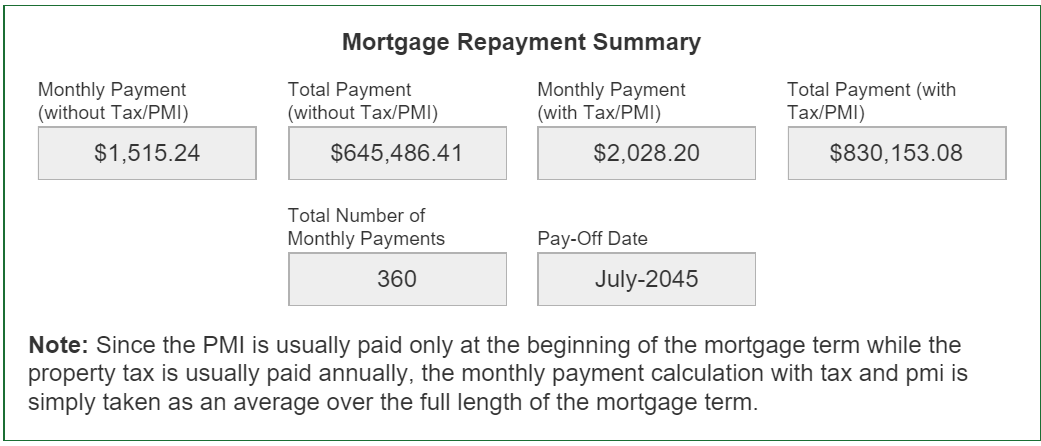

Here’s a breakdown of how to calculate your monthly mortgage payment using various methods:Ĭalculating by Hand Using the Mortgage Payment Formula: While online mortgage calculators, spreadsheets, or financial calculators are the go-to tools for most people looking to find out their principal and interest payment (P&I), understanding how to calculate this by hand or with other tools can provide deeper insight into your home loan. GEEK OUT: EQUATION TO CALCULATE YOUR MORTGAGE PAYMENT Consult a mortgage expert for personalized, accurate advice. View the amortization schedule to see how each payment divides between principal and interest, showcasing the decreasing loan balance.Ĭhange the input values (e.g., increase the down payment or adjust the loan term) to observe variations in monthly costs.ĭisclaimer: This tool provides general estimates. The calculator presents an itemized monthly estimate: principal, interest, taxes, insurances, and fees. HOA Fees: Input if your property belongs to a homeowners association. Private Mortgage Insurance (PMI): Applicable if the down payment is under 20% of the home price. Homeowners Insurance: Coverage cost for property damage. Property Tax: Usually a percentage of the home's value.

(You can input these as monthly or yearly amounts) Interest Rate: Insert the annual rate your lender is offering. Loan Terms: Choose your mortgage duration (e.g., 10, 15, 20, 25, 30 years).

Mortgage calculator extra payment 2 weeks later full#

Home Price: Enter the home's full purchase price.ĭown Payment: Type the upfront payment amount, either in dollars or as a percentage. Use our mortgage calculator to get a detailed view of your monthly payments and understand your financial obligations over time. Different terms, fees or other loan amounts might result in a different comparison rate.Buying a home is a monumental financial decision. WARNING: This comparison rate is true only for the example given and may not include all fees and charges. The comparison rate is based on a loan amount of $150,000 over a loan term of 25 years. To view these documents you may need Adobe Acrobat. Before making any decision in relation to our home loan products you should read the relevant Terms and Conditions booklet. Any advice on this website does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. The offset facility is only available on the Orange Advantage home loan account when linked to an Orange Everyday account. There is no offset facility available on a fixed rate loan. Any additional payments or advanced funds are not available for redraw during the fixed interest period. You should refer to the Home Loan terms and conditions for details and contact us on 133 464 for an estimate of the break costs that may be payable by you in the above circumstances. WARNING: If you select a fixed rate loan, break costs may be payable if, at any time before the fixed rate expires, you (1) pay out your loan, make an additional payment of $10,000 or more, or you make additional payments totalling $10,000 or more in any one-year period (with the first one-year period starting on the first day of the fixed interest period), or (2) you ask us to make certain changes to your loan including but not limited to your loan type, your repayment type, your loan purpose, your fixed interest period, the security on your property, your approved loan amount, your loan term, the borrowers on your loan or any other change that requires your loan to be re-documented. All features are not available for every type of loan. Details of these and the terms and conditions are available at or by calling 133 464. All applications for credit are subject to ING's credit approval criteria. All rates and information are correct at time of publication and are subject to change.

0 kommentar(er)

0 kommentar(er)